Optimise retirement income portfolios with a new asset

As clients move into retirement and their income from work ceases, it’s natural for many to reassess the level of investment risk they’re comfortable with.

Navigating market volatility in recent years has not been for the faint-hearted, and with the virtually risk-free opportunities to earn 4-5% on cash now available, it’s no surprise that many peoples’ attitude to investment risk is reducing, something which Aegon Next Wealth reported on in late 20221.

However, a client relying on income from their drawdown portfolio has to be prepared to take some risk. Otherwise, the level of income that their portfolio can sustain for as long as they live, and the ability to mitigate inflation, may be limited, as can leaving a legacy.

The capacity for loss conundrum

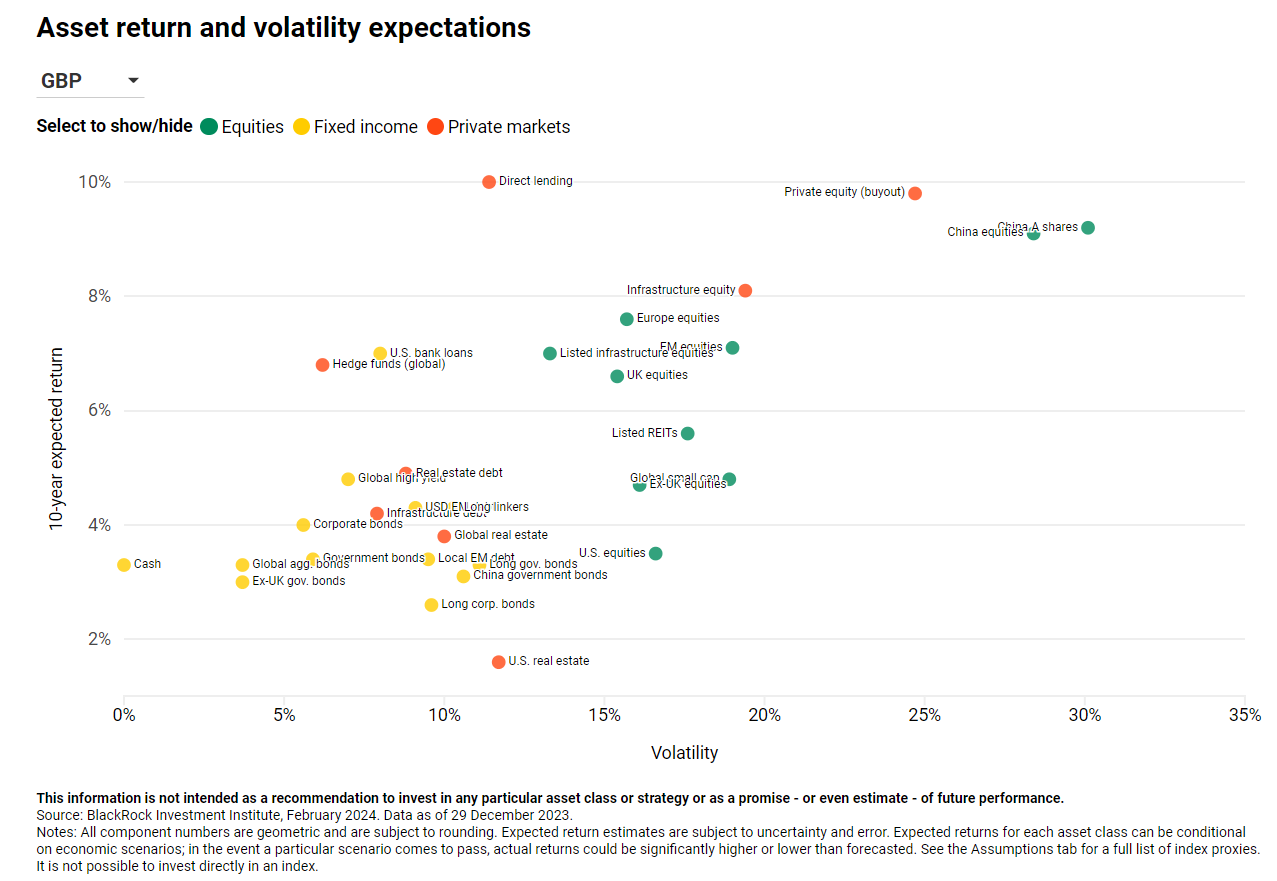

A limited capacity for loss is likely to result in a client’s portfolio being steered away from some of the asset classes with potentially higher long-term growth, such as emerging market equity or global private equity (see chart below). This can happen because some of these higher projected growth opportunities have historically suffered larger maximum losses than other sectors, so capacity for loss based risk profiling naturally steers asset allocation away from these areas.

Source: https://www.blackrock.com/institutions/en-us/insights/charts/capital-market-assumptions

Chart last updated on 15 May 2024.

So, if (model) portfolios are being built to avoid historically volatile markets, which could be the growth areas of the future, how can we justify taking that additional risk if the client’s risk profile is nudging them towards safer assets, where ‘safer’ often means bonds or bond like investments?

How safe are ‘safer’ assets?

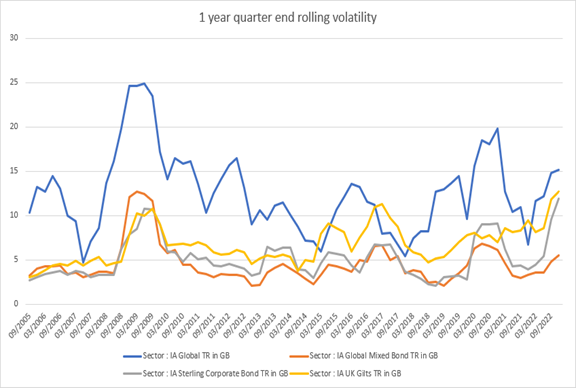

Investment risk in a portfolio is relative. If less risk is taken in one area of a portfolio, risk can be dialled-up elsewhere. That lower risk element used to be bonds, or the bond like investments that many flocked to over the last two decades as bond yields continued falling. The volatility of these ‘safer’ assets has massively increased of late. Areas such as UK gilts and sterling corporate bonds are experiencing higher levels of volatility than we observed during the Great Financial Crisis of 2007-8.

Data provided by FE Analytics, bid-bid TR, 1-year quarter-end rolling volatility,30/09/2005 – 30/09/2022, in GBP

However, it’s not just volatility that’s important. Liquidity is very important too, particularly to those relying on their portfolios for income in-retirement. Whilst many of the bond-like alternatives such as property or infrastructure funds offer daily liquidity, this isn’t always supported by the underlying assets which are inherently illiquid.

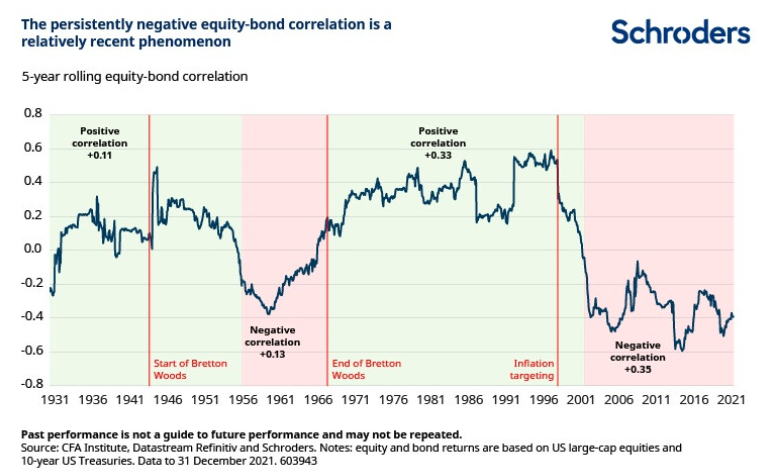

Then there’s the change from negative correlation between equities and bonds, that appears to be reverting back to positive correlation. Over the last 90 years this has been more the norm and would result in portfolios no longer being as diversified as they were with equity-bond negative correlation.

Source: https://www.schroders.com/en-us/us/institutional/insights/what-drives-the-equity-bond-correlation/

Some of the ‘safer’ assets that clients are likely to be encouraged to increase their weighting to, as their investment risk appetite reduces in later life, are not as safe, liquid or uncorrelated to equities as they once were.

Improving the risk budget

So, if your client’s portfolio is more volatile, how can you justify increasing the risk budget to access the higher predicted growth assets of the future? So that you can help your client better maintain the portfolio’s purchasing power, when those growth areas have historically been more volatile? What assets can you access that will bring the portfolio’s overall volatility down, and importantly keep it down, allowing you the risk budget to take that type of equity risk?

These are the discussions we at Just have been having with Discretionary Fund Managers (DFMs), asset managers and advisers across the UK. We’ve been exploring how embedding a new asset class that delivers a guaranteed income stream which is both non-volatile and uncorrelated to equities and bonds into a portfolio could help.

Our work with experts in managing money and building portfolios is truly ground-breaking. We’re now starting to see solutions come to market where a guaranteed income producing asset provided by our Secure Lifetime Income (SLI) are being brought into the asset allocation framework.

Accessed on platform, SLI delivers a trustee investment asset in the SIPP portfolio. SLI provides a personalised income stream, guaranteed for life which can be higher than is normally attainable from traditional fixed income

Including our new guaranteed income asset class alongside other portfolio assets enables solutions which can cope better with sequence and longevity risk than traditional bond-equity asset allocations. The new asset’s lack of volatility and correlation to equities and bonds enables asset managers to take more risk in the equity bucket than they would otherwise be able to do with a traditional asset allocation. At the same time they could improve the probability of success in sustaining the client’s required income and boost the projected legacy value of the pension.

Exploring all avenues

During this period of macro-economic and geo-political uncertainty, it’s important that every pound of a client’s retirement income portfolio is being optimised and contributing towards a successful outcome, whilst aligning to their willingness to take capital market risk and their ability to withstand it.

With traditional fixed income no longer pulling its weight and providing the degree of diversification we’ve become use to, and most ‘alternatives’ having very different risk characteristics, all avenues need to be explored. We’ve been sharing independent research and analysis with investment professionals and it’s starting to turn a few heads. We believe we’re seeing a growing realisation that including a guaranteed income producing asset into the asset allocation process offers improved investor outcomes.

If you’d like to hear more about SLI and managing risk budget in retirement income portfolios, please get in touch with us, either by phone on 0345 302 2287 or via email at support@wearejust.co.uk

1https://www.nextwealth.co.uk/research/managing-lifetime-wealth-retirement-planning-in-the-uk-2023