Why underwriting is important, how it works and the difference it makes

Underwriting enables providers to build an accurate picture of your client’s circumstances.

Everyone’s personal, lifestyle and medical information is individual to that person, and is used to give a better view on how long someone is likely to live for. This in turn means a provider can offer a tailored level of Guaranteed Income for Life (GIfL) specific to that client.

Under today’s FCA rules, providers quotes should include a whole of market comparison prompt, subject to client consent. In addition financial intermediaries are now required to enquire about their client’s personal, lifestyle and medical information in order to secure the best possible rate

Changes in underwriting

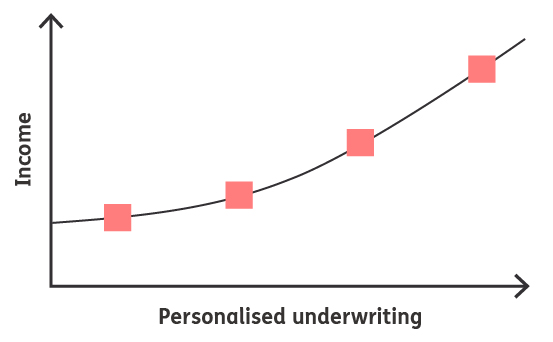

Underwriting techniques have evolved over many years and combined with medical advances and the wealth of data available; we can say that everyone has their own ‘personalised’ rate of income.

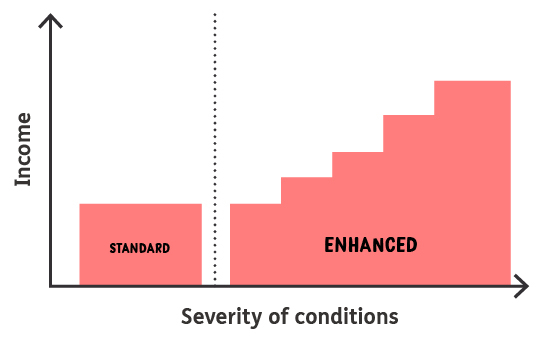

Previously, annuities were either ‘standard’ or, if a client ‘qualified’ due to lifestyle/medical conditions, they secured an ‘enhanced’ annuity.

In today’s market, lifestyle factors, like smoking, alcohol consumption and Body Mass Index (BMI) readings can affect the rate offered, and even seemingly unimportant details like postcode and marital status can make a difference.

How it works

Underwriting information generally falls into three main areas:

- Personal – such as age, marital status and post code.

- Lifestyle – simple things like Body Mass Index (BMI) reading, smoking history and alcohol intake.

- Medical – any diagnosed medical condition ranging from high blood pressure or high cholesterol, through to diabetes or more severe conditions such as cancer.

Underwriting uses the information gathered to assess an individual’s likely life expectancy. Of course, no two people are the same, so underwriting enables the calculation of a unique, personalised rate that is specific to your client.

The difference that personalised underwriting makes

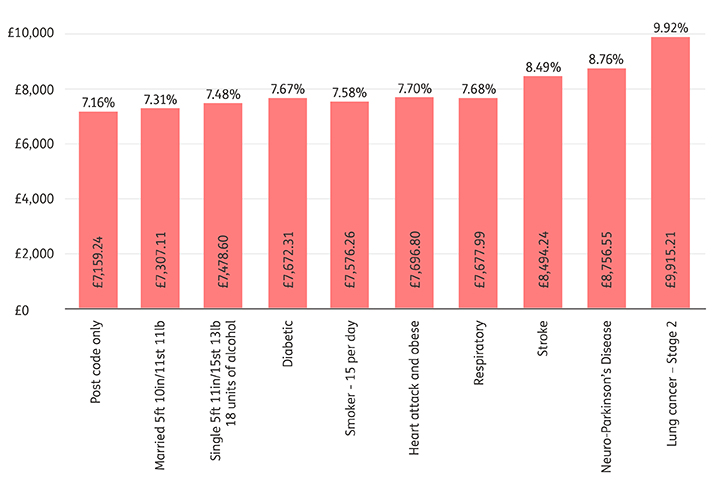

As the examples in the chart demonstrate, all personal, lifestyle and medical information can make a difference when comparing to a GIfL that hasn't been underwritten.

Client aged 65, £100k net fund, single life, no escalation with a 5 year guarantee period, monthly in advance*.

*Just rates at 15 April 2025 based on an individual being married, 5ft 10in/13st 10lb, 7 units of alcohol weekly unless otherwise stated. Allows for 2% adviser charge.