The vulnerability spectrum

All customers are at risk of becoming vulnerable, whatever their age or financial status, but the risk is increased by having characteristics of vulnerability.

There are four key drivers of vulnerability:

- Health – conditions such as cognitive impairment, which affect a person’s ability to carry out their day-to-day tasks

- Life events – for example, bereavement, divorce, job loss or new caring responsibilities

- Resilience – low ability to withstand financial of emotional strain

- Capability – low knowledge of financial matters or low confidence in managing money (financial capability). Or low capability in other relevant areas such as literacy or digital skills.

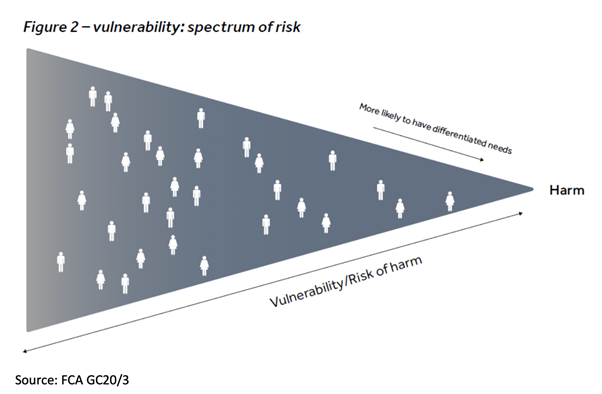

The Financial Conduct Authority (FCA) have adopted the concept of a ‘spectrum of vulnerability’. Customers can move up and down this spectrum depending on their circumstances. Being vulnerable is not a fixed state, but instead transient.

Customers to the left of the spectrum are less likely to be vulnerable than those to the right, who are deemed at greatest risk of harm. The new Consumer Duty proposes that where people in vulnerable circumstances are at greater risk of harm, firms should take additional care to ensure they achieve outcomes as good as those experienced by consumers deemed not vulnerable.

Customers along the spectrum will have differing needs and be at different stages in their life; they will all be experiencing things differently.

For example, a customer who’s lost their job or falls ill is likely to have different or more needs than others. If these aren’t met, they may be vulnerable to harm.

If they also have low resilience or capability, they’re likely to need more support and can be at greater risk of harm without it.

Customers at the greatest risk of harm are likely to require more, or different, support than others. They may also need prompt help to prevent risk of harm growing, for example protection from financial scams.

Where a firm can identify a customer in vulnerable circumstances, and support them effectively, the risk of harm is reduced. The FCA are looking for more consistency among firms so that consumers get a more equal service whichever firm they interact with.

The principles of good consumer outcomes need to be embedded into the culture, policy and procedures of a firm. A firm’s vulnerable customer policy for example should not just be a tick-box exercise, but one that is re-visited often and at every touch point of the customer’s journey. It should come naturally to all employees to focus on good customer outcomes for ALL clients, wherever they sit on the vulnerability spectrum.

To help you achieve good customer outcomes for all of your clients, see below for a list of useful resources.