Retirement income that flies in the face of market uncertainty

On 12 February 2024, we updated this article which was originally published on 15 November 2023.

Through 2023, market expectations have changed. The rhetoric of the central banks has pivoted to ‘higher interest rates for longer’. Language which has left markets struggling to find a footing and unable to generate growth above what is now readily available via high street banks. Even National Savings products offered an impressive 6.2% for 12 months at one point.

The traditional 60:40 portfolio has also struggled to recover from the late 2021 sell off across both equities and bonds. Investors, starting with a 4% withdrawal rate in early January 2021, are now facing a 4.6% withdrawal rate according to valuations on 1 February 2024. With the disturbances in Middle East a cause of further geopolitical tension for global markets to contend with, there’s little sign of a turn-around.

Capital market assumptions and uncertainty

Adding to this backdrop, recently issued capital market assumptions are concerning, particularly for those in decumulation looking for sustainable income.

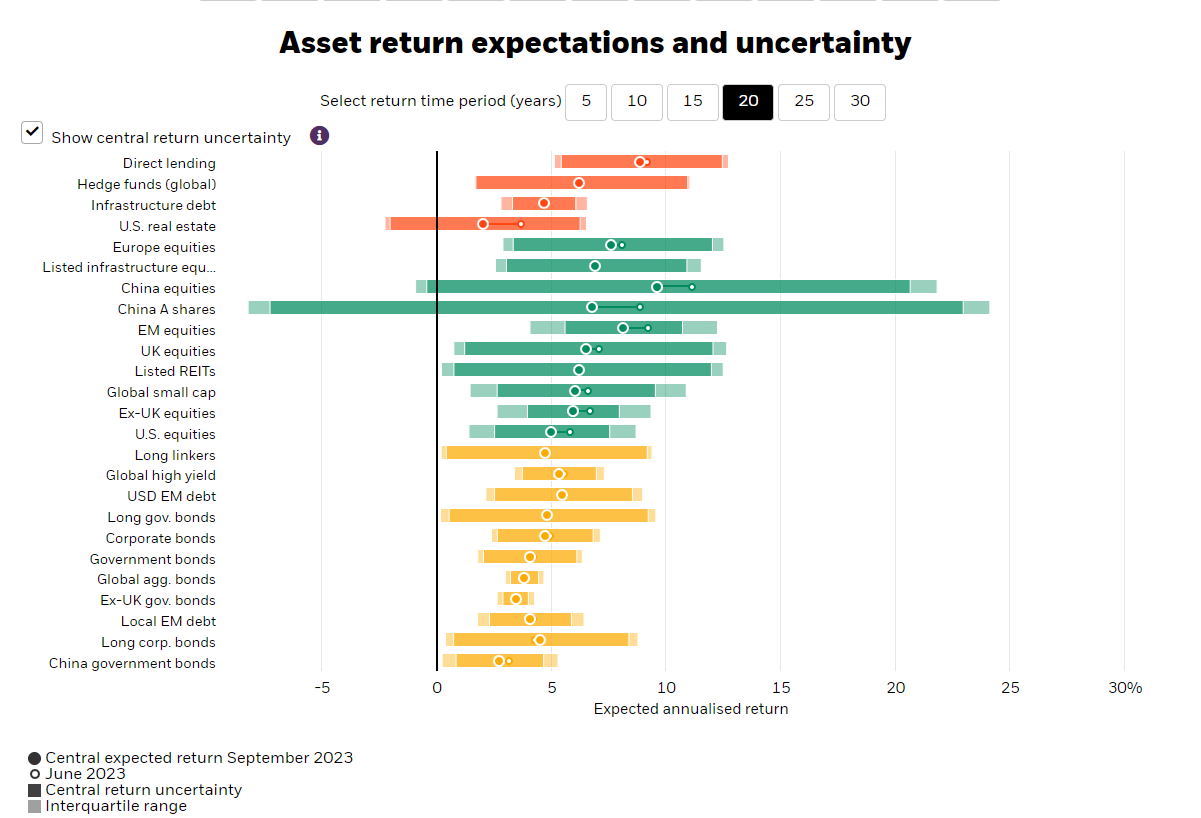

The capital market assumptions released by Blackrock over the summer highlighted that, whilst projected market returns over the next 20 years have improved from where they were in the previous release, uncertainty of potential returns remains significant, as the chart below illustrates. If these assumptions prove to be close to reality over the next 20 years, timing, careful manager selection and weighting to each asset class in a portfolio, could have a significant impact on getting the best of available returns.

Source: BlackRock Investment Institute, November 2023. Data as of 30 September 20231

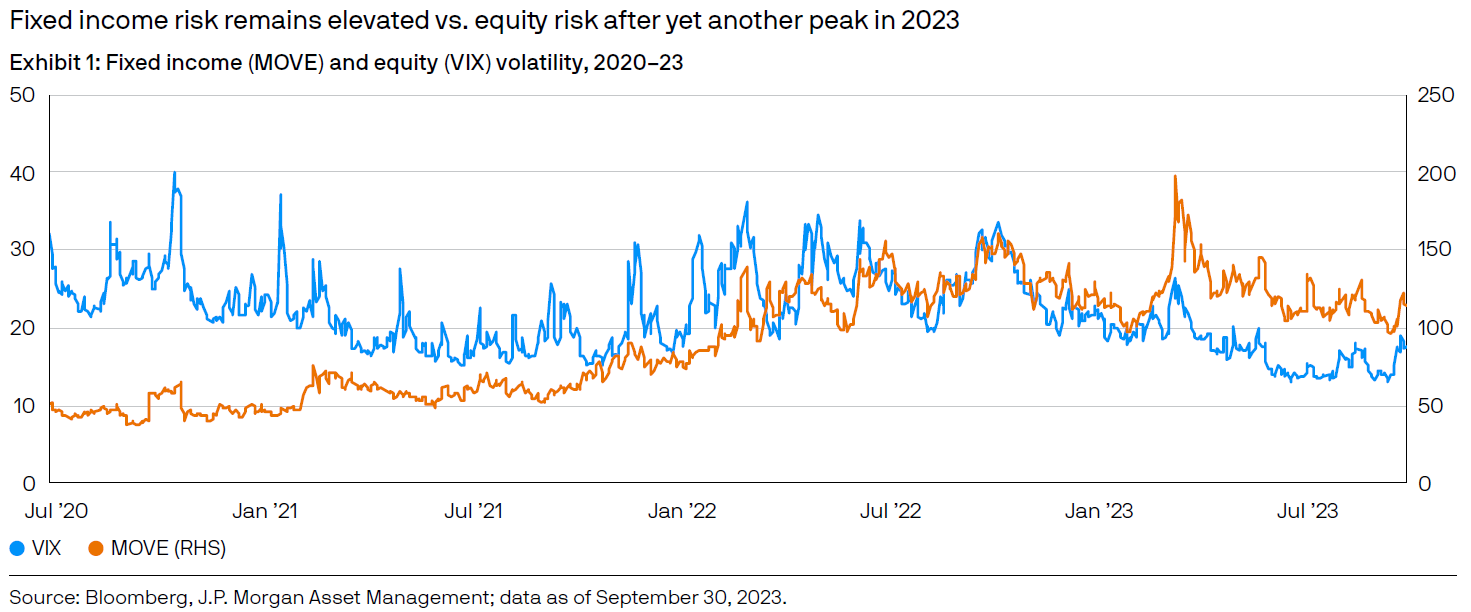

To add to this uncertainty, JP Morgan stated in their latest set of long-term capital market assumptions that for a second year, their assumptions forecast more elevated bond volatility and less negative stock-bond correlation. They added that they expect macroeconomic volatility to return and central bank policies to normalise – bringing back bond returns but also bond volatility which can be seen in the chart below. Bonds have long been seen as a key diversifier to equities and the asset class most often used to dampen volatility and therefore sequence risk, a key component of risk management for those in decumulation.

Balancing the sequence and longevity risks “seesaw”

The combination of lower future growth and more volatility does not bode well for managing a retirement income portfolio. As we know sequence and longevity are two key risks which have to be balanced carefully.

On one side of the seesaw, longevity risk is managed by holding growth assets to sustain growth and beat inflation over the longer term. However, the more equity that is held, the more portfolio volatility increases and so the more sequencing risk there is likely to be on the other side of the seesaw.

Investment managers then use bonds and other defensive assets to lower the sequencing risk side of the seesaw. But some of those assets are now more volatile and correlating with equities. Without reliable diversifiers, the challenge of balancing the risks seesaw throughout a retiree’s life has become potentially much harder.

So, what’s the solution?

Blending a guaranteed income producing asset, such as Just's Secure Lifetime Income, into the asset allocation of a retirement income portfolio can help to dampen sequencing risk, as it’s non-volatile and non-correlated to other assets in the portfolio. At the same time it can dampen longevity risk, as the income it generates is payable for life.

Risk profilers, cash flow modellers and DFMs

At Just Group we’re working with discretionary fund managers (DFMs), risk profilers and cash flow modellers to help embed lifetime guaranteed income across the tool kit financial planners and investment managers use. So, not only can guaranteed income be purchased directly on platforms, but also included in the risk and cashflow modelling techniques that advisers use and which DFMs follow. Thus, enabling them to easily adjust asset allocations around the guaranteed income which can help deliver higher income and/or portfolio values.

In a recent webinar the risk profiler and behavioural finance experts, Oxford Risk, spoke about how a retiree’s investible portfolio could be appropriately adjusted to account for any guaranteed income. A timely intervention, considering one of the FCA’s questions in their retirement income thematic review asked if firms have a standard for how much secure income a customer should have as a proportion of their overall income.

This question could be key when one considers the Consumer Duty cross-cutting rule that states, firms should avoid foreseeable harm for customers, where that ‘foreseeable harm’ could relate to a retiree running out of money, or could also relate to the potential anxiety caused by fear of one’s income in retirement becoming too unreliable or volatile, resulting in under spending.

Just’s work with DFMs includes a collaboration with Albermarle Street Partners. They’re adapting their illustrations tool which incorporates stochastic modelling techniques with life expectancy data. This will enable their adviser firms to take a more holistic approach to using lifetime guaranteed income. The process will allow advisers to consider the right profile in the context of the guaranteed income and the impact it has on reducing sequence and longevity risks.

If you’d like to find out more about how Secure Lifetime Income and managing risk budget in retirement income portfolios could benefit your clients and firm, please get in touch by calling 0345 302 2287 or emailing support@wearejust.co.uk.

1 balancing risks seesaw in retirement' Capital market assumptions, Blackrock Investment Institute, November 2023. Data as of 30 September 2023 (https://www.blackrock.com/institutions/en-us/insights/charts/capital-market-assumptions)