Flexibility and options

Our Pension Annuity gives clients a guaranteed income for life which isn’t affected by interest rate changes or stock market volatility. We offer a comprehensive range of benefits and options, helping you meet the individual needs of each client.

Most people can choose to take up to 25% of their pension fund as a tax-free lump-sum subject to a limit on tax free lump sums called the lump sum allowance. This limit is normally £268,275, however it could be higher if your client has protection from the Lifetime Allowance.

Points to consider

- Clients can use their tax-free lump-sum for any purpose, for example, addressing other financial needs they may have in retirement.

- Once they’ve received their tax-free lump-sum, they can’t change their mind.

- Generally, only 25% of pension savings can be taken tax-free – withdrawals above this will be subject to tax at their marginal rate of income tax.

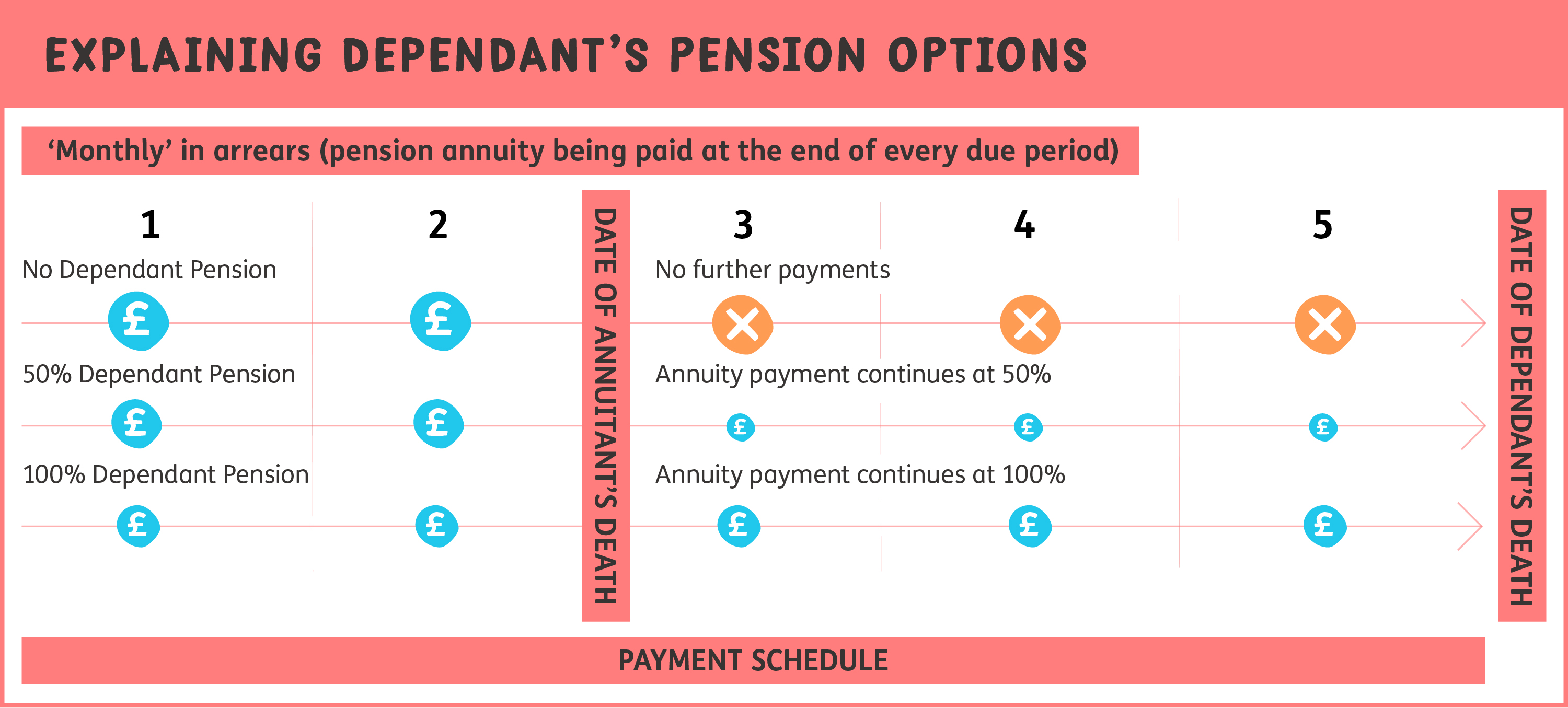

A dependants pension pays a fixed percentage of the annuity to the dependant (for example, a spouse or civil partner) for as long as they live.

Clients can choose to cover any percentage of income, depending on their needs and circumstances. The diagram below shows how the option works across different levels of cover:

Points to consider

- Clients can provide the medical details of their dependant, so they too can be factored into an underwritten quote.

- There's a cost for this choice - the greater the dependant's benefit, the lower the income received.

- It’s worth looking at the benefits provided by any other pensions, savings or life assurance policies and considering this option alongside them.

- If a client with a joint life annuity dies before the age of 75, any payments to their dependants will be tax-free. If they die having attained age 75, the income will be taxed at the dependant's marginal rate of tax*.

*References to taxation are dependent on individual circumstances and subject to change.

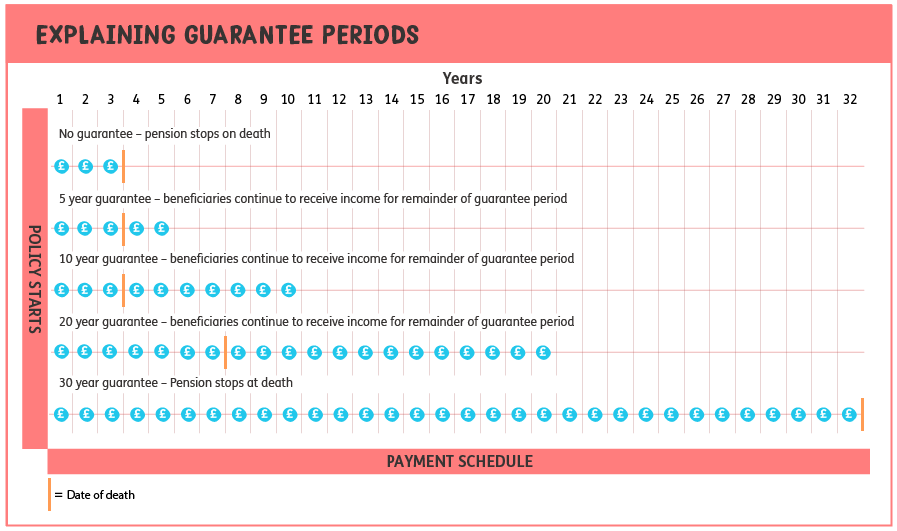

Clients can select a guarantee period (up to 30 years from the first payment), so if they die before the end of the guarantee the income will continue to be paid until the end of the period.

See below for an overview of how this option can work:

Points to consider

- Clients can choose a guarantee period between one and 30 years.

- There’s a cost for this choice – the longer the guarantee period, the lower the income received.

- If they live past the guarantee period, then the income will continue until the client dies.

- If a client dies before the age of 75 and has a guarantee period, any payments made to beneficiaries will be tax-free*. If they die having attained age 75, any payments will be taxed at the beneficiaries’ marginal rate of tax**.

- A guarantee period isn't available if value protection has been selected.

*If the guarantee period is payable as a lump sum under a scheme pension annuity, it would be subject the lump sum and death benefit allowance (see Value Protection section for more information).

**References to taxation are dependent on individual circumstances and subject to change.

Clients can choose to protect up to 100% of the annuity purchase price. Should the policyholder die without having received the full value of their annuity purchase price in income, the value protection benefit will return a percentage of the annuity purchase price less the income payments made up to the date of death.

The protected amount less any payments already made is paid to the beneficiary/ries as a lump sum.

The lump sum will be tax-free if a client dies before the age of 75, up to the lump sum and death benefit allowance. If they die having attained age 75, the income will be taxed at the beneficiaries marginal rate of tax.

For policies that were taken after 6 April 2024, any lump sum payments that include value protection will be included in the annuitant's allowance for tax-free lump sums and death benefits. Normally, this allowance is £1,073,100.

If an annuitant has protection from the lifetime allowance, this limit could be higher.

If the value protection lump sum exceeds this limit, the extra amount will be taxed at the recipient's marginal rate of tax.

Points to consider

- A value protection lump sum isn’t normally counted as part of the estate for inheritance tax purposes. However, the government have announced that it may be subject to inheritance tax from 6 April 2027. This is subject to consultation and may change.

- There's a cost for this choice - the greater the protected amount, the lower the income received.

- It’s available with or without a dependant's pension selected. It’s available on a first or second life basis where the client has put in place a dependant's pension.

- It isn't available if a guarantee period has been selected.

- If the total gross income payments already made exceeds the protected amount, no lump sum will be paid on death.

- To find out more information about how value protection can benefit clients, please see our key features document.

If a client chooses not to include a guarantee period, dependant's pension or value protection, their annuity income would stop when they die and no further payments would be made.

*References to taxation are dependent on individual circumstances and subject to change.

Inflation can affect a client's retirement income over time. Clients can choose to automatically increase the income they receive each year by either a set percentage (e.g. 3% or 5%), or by linking to a measure of inflation such as the Retail Prices Index (RPI). These options will reduce the starting income but give the client peace of mind that their income will grow by the rate chosen.

Points to consider

- If escalation is not chosen future increases in the cost of living may reduce the real value of the annuity income received.

- In times of deflation, taking the "RPI no floor" index linked escalation option will result in the annuity income received reducing.

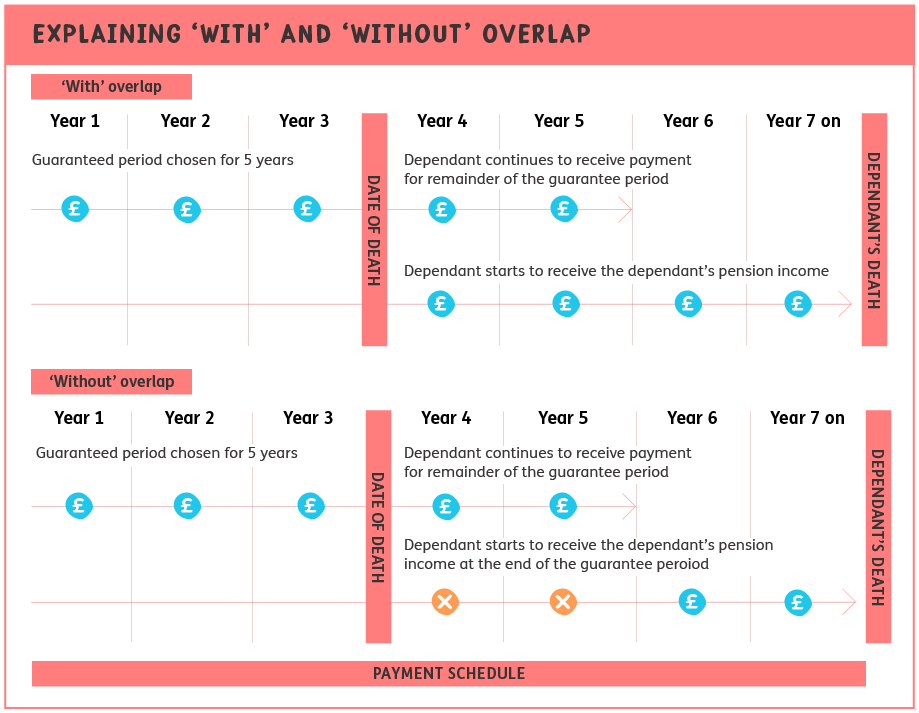

If a client has chosen both a dependant's income and a guaranteed period, they can specify when the dependant’s income should start. This decision is made when the annuity is set up and they can choose between:

With overlap: The dependant’s income starts on your client's death during the guaranteed period, so until the end of the guarantee period we'll pay both their annuity and the dependant’s income. Once the guaranteed period has ended only the dependant’s income will be paid.

Without overlap: The dependant’s income only starts from the end of the guarantee period.

See the diagram below for an illustration of how this works:

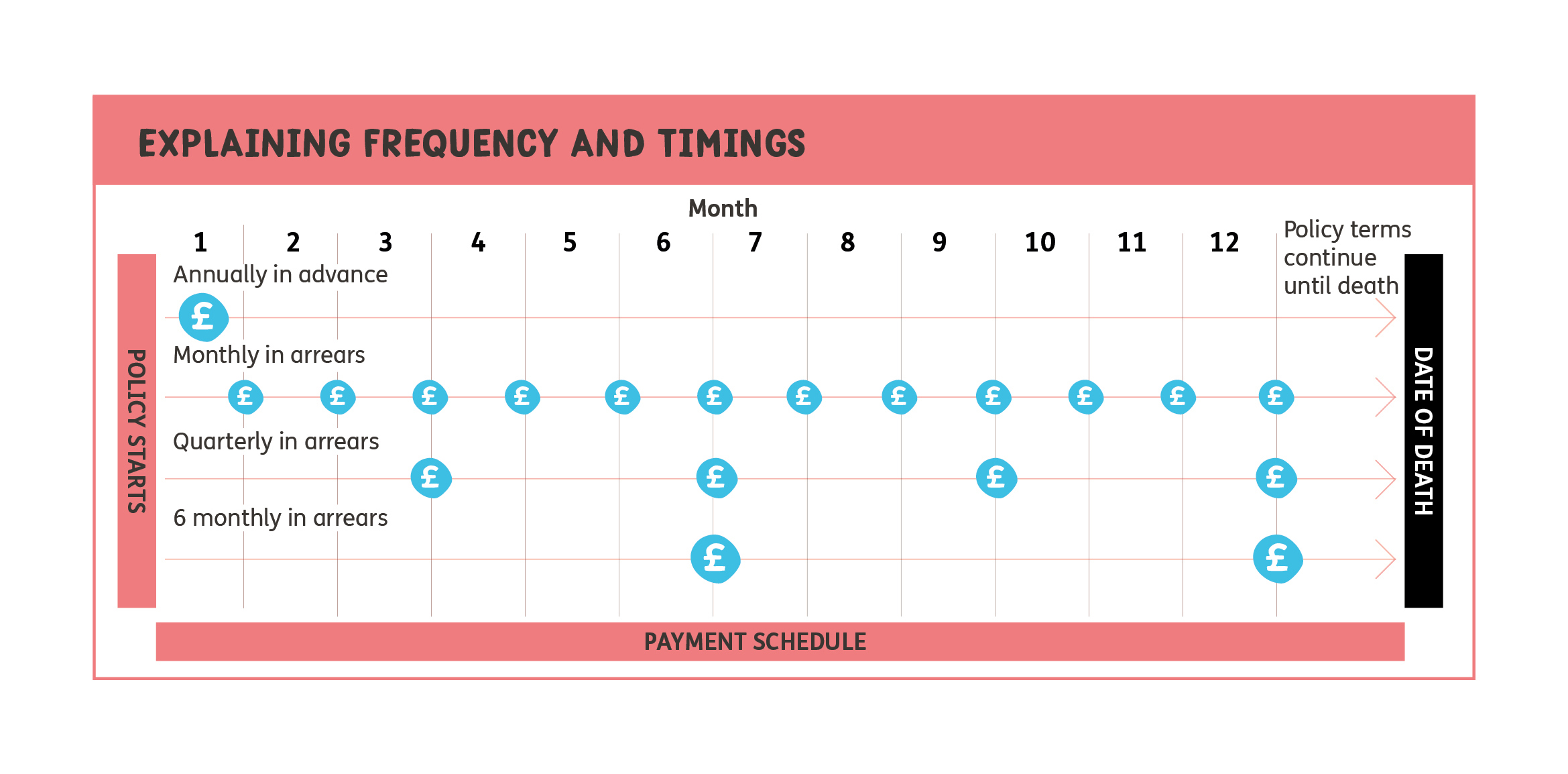

Clients can choose to take their retirement income monthly, quarterly, every six months or annually. It can be paid either in advance or at the end of the chosen frequency period (in arrears).

The diagram below shows how this works:

Points to consider

- Choosing the frequency of payments will depend on the client's individual circumstances; e.g. how easy budgeting between payments is, and the impact it has on their retirement income.

- Choosing overlapping payments will impact the starting income.

- Payments will stop when the client dies, unless a guaranteed period, dependant's benefit or value protection options are chosen at the time of the original purchase.

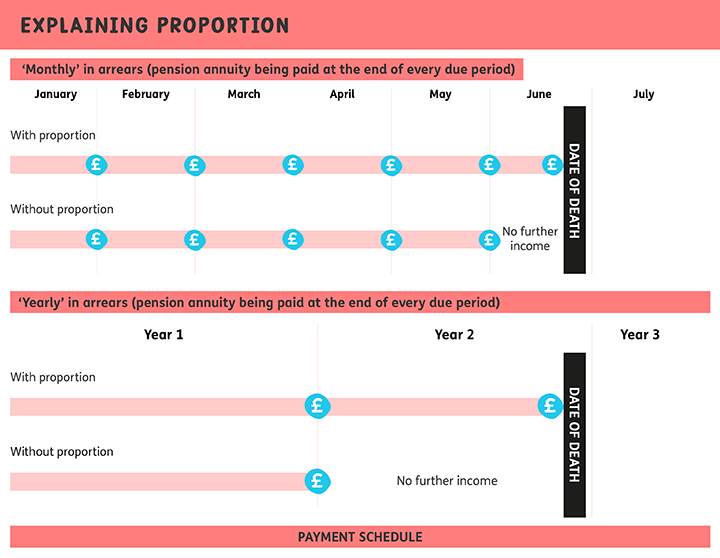

If a client chooses to be paid in arrears, there’s a further option to make a final payment on their death to their nominated beneficiaries, which covers the period between the last payment date and the client’s date of death. The diagram below helps to explain how this feature works:

If income is paid less frequently (e.g. annually) and in arrears, the final (proportional) payment due on death could be more substantial.

To find out more about our Pension Annuity, please view our dedicated product page.

Alternatively, you can contact our Customer Support team on 0345 302 2287 or support@wearejust.co.uk.