Retirement can be unforgiving without effective planning

Helping people plan at retirement is very different from helping people save for retirement.

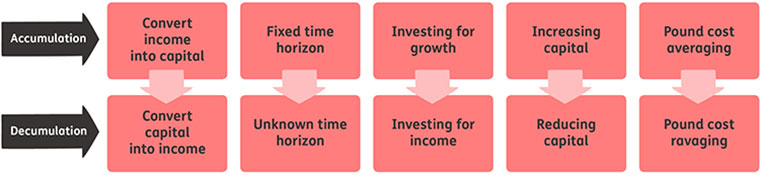

In the accumulation phase, people save from income to build capital, usually over a fixed-term, and with regular saving, can benefit from pound cost averaging.

In the decumulation phase, capital is converted to income. The time horizon is unknown and the opposite of pound cost averaging, commonly called ‘pound cost ravaging’, can be devastating.

Advice processes need to recognise the challenges people face in retirement. For example, clients who don’t save enough before retirement could end up with less money than they expected; clients who withdraw too much in retirement could run out of money completely.

Many firms use a centralised retirement proposition (CRP) to help manage the risks clients face during retirement. Whether you formally adopt a CRP or not, it’s important that you have an effective, evidence-based process that covers all of the issues clients face as they enter retirement.

The ‘Useful Links’ take you to information that will help make your retirement processes more robust.