Retirement is no longer a linear journey

Retirement is very different these days, compared to say, the 1960s.

Men typically retired at 65 and women at 60. Once retired, men could expect to live on average 14 more years to 79, and women to 82. And, not many people continued to work.

Today, a 65-year old man in reasonable health has a one in four chance of living to 92 and 65-year woman to 94*.

This has profound consequences for retirement planning.

Retirement is no longer a fixed point for many people as they may continue to work especially with the increased cost of living.

And a longer life doesn’t necessarily mean a healthier life as on average, men and women will spend around half their retirement in ill health.

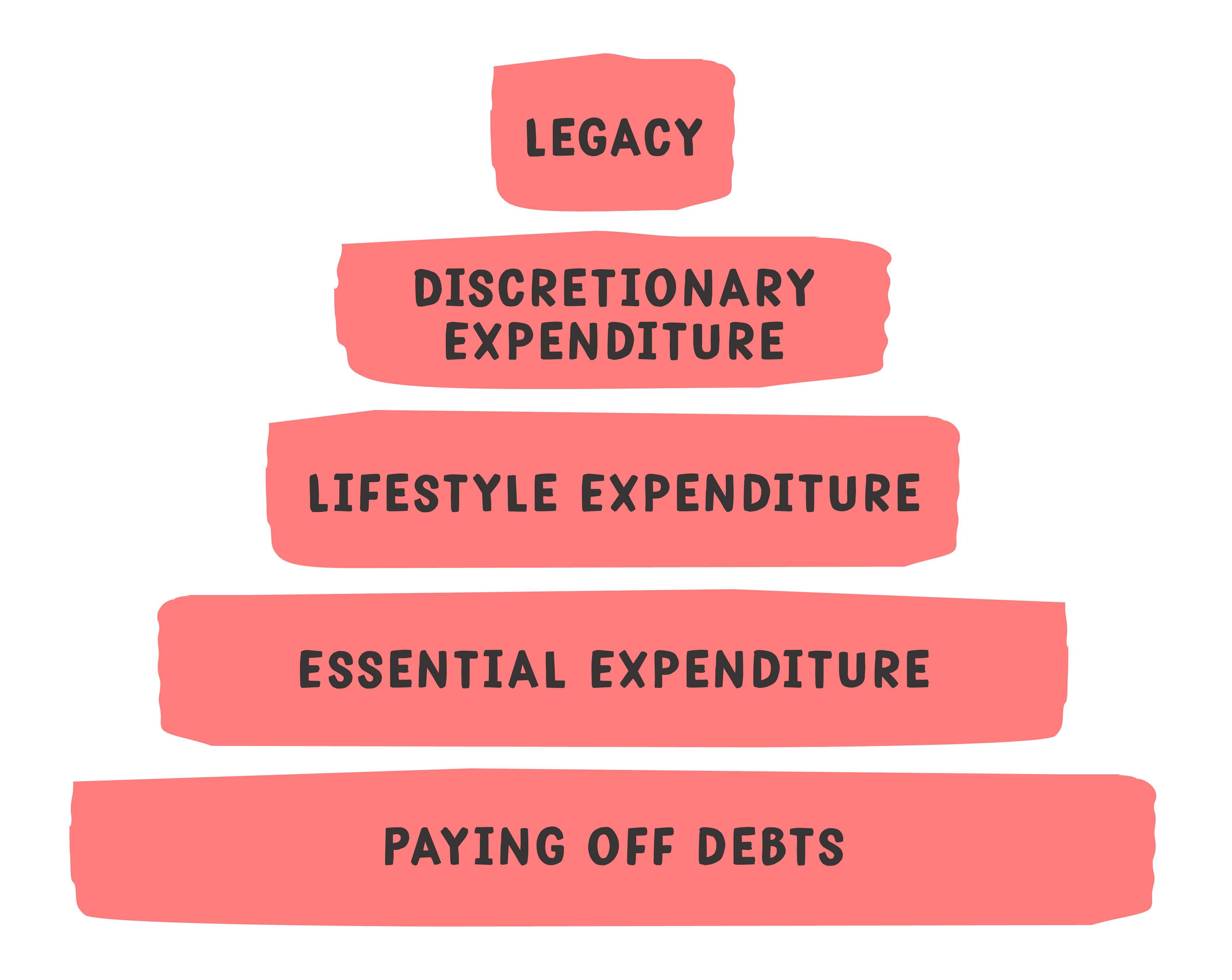

Structuring income in retirement is more complex and should recognise the different types of expenditure, reflecting how these costs change in different phases of retirement.

The model below provides a framework to prioritise expenditure throughout a client’s retirement.