The regulator's perspective

Consumers with defined contribution (DC) savings have, since the implementation of pension freedoms in 2015, had great flexibility about how and when they access their funds. However, these freedoms come with complexity and potential risks which could have a significant financial impact on a person’s retirement.

Following the introduction of pension freedoms, the FCA launched the Retirement Outcomes Review to assess how the market has evolved. The final report was published in June 2018 and that’s led to a package of proposed remedies to address the concerns identified, including those policy statements listed below.

A major landmark since pension freedoms was the FCA’s thematic review of retirement income advice, published in 2024. The FCA’s review identified both good and poor practices across firms advising on retirement income. While some firms demonstrated robust, client-focused models, others failed to meet regulatory expectations, risking poor outcomes. The review emphasised the importance of personalised advice, accurate record-keeping, and sustainable income strategies. Firms are urged to align with Consumer Duty principles, improve systems and controls, and monitor client outcomes.

To help consumers get more support on their DC pension choices, the government set up Pension Wise, a service provided by MoneyHelper.

Pension Wise offers people free and impartial guidance about their options and associated risks so they can make informed decisions about accessing their pension funds.

Satisfaction with the Pension Wise service in 2019/2020 was very high; 94% of all appointment customers were very or fairly satisfied with their overall experience, with 88% saying Pension Wise helped improve their understanding of their pension options. However, figures showed that only 14% of consumers accessing a DC pension fund for the first time used Pension Wise. In order to increase usage of this service, the FCA published PS21/21 The stronger nudge to pensions guidance, effective from 1 June 2022.

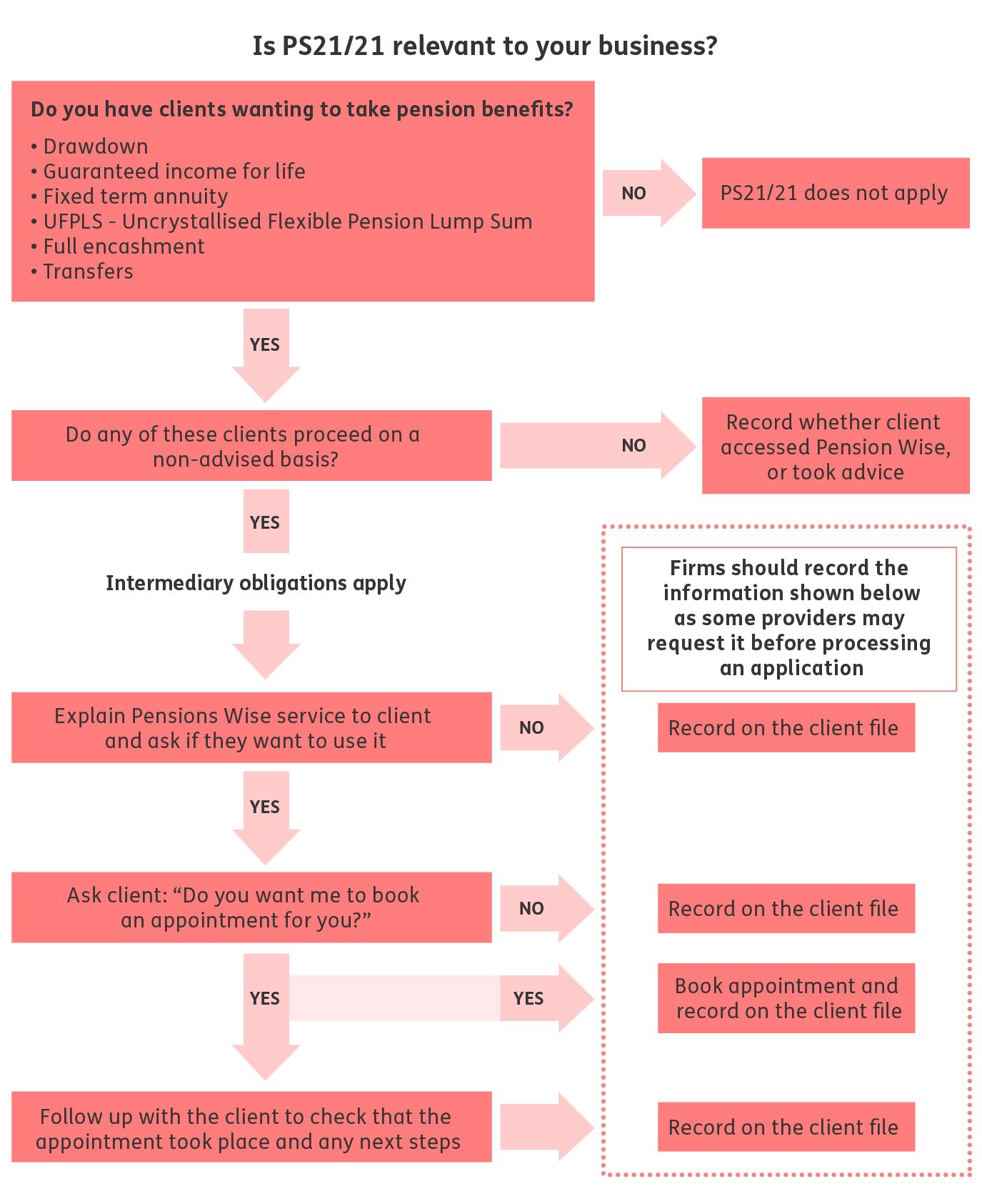

The new rules mean consumers must be given a ‘stronger nudge’ to use Pension Wise, and impact most stakeholders involved in pension provision: product providers (accumulation and decumulation), financial intermediaries, charities, trade bodies (see chart below for more information).

Providing this ‘stronger nudge’ comes in three distinct parts:

- Refer the consumer to Pension Wise guidance

- Explain the nature and purpose of Pension Wise guidance

- Offer to book Pension Wise guidance appointment and, where the consumer accepts that offer, book the appointment or provide the consumer with sufficient information to book their own appointment.

Previously, firms had to confirm and record whether the customer had received Pension Wise guidance or regulated advice. The new rules mean they must also confirm and record whether the member declined the offer to receive the Pension Wise guidance (opted out).

Potential outcomes

These stronger nudges are designed to increase the take-up of the Pension Wise service, helping consumers to make more informed decisions.

It could also lead to more people shopping around or seeking qualified advice about their options before deciding what to do. Evaluation of the Pension Wise service shows that over a third of users (36%) go on to seek professional advice, compared with 22% of non-users.

This included:

- Introducing ‘investment pathways’ for consumers entering drawdown without taking advice.

- Ensuring that if a consumer enters drawdown and is to invest mainly in cash, they have taken an active decision to do so.

- Requiring firms to send annual information on costs and charges for the previous year to consumers who have accessed their pension.

This included:

- Revised rules about the information sent to consumers before they decide how to access their pension savings.

- Expectations that firms should ask questions regarding their client’s lifestyle and health to assess their eligibility for an ‘enhanced’ annuity and then generate both their own and market-leading rates.

- Changes to make the cost of drawdown products clearer and more comparable. Requirements enabling clarity around the costs of drawdown came into force in April 2020.