Pension assets for retirement income...who'd have thought?

The inheritance tax (IHT) reforms due in April 2027, will mean that most unused pension assets will fall within the taxable estate. Stuart Slegg, Just’s Head of Retail Investment Solutions, explores the impact this will have on retirement planning strategies and the steps advisers could take to soothe the nerves of anxious clients.

You don’t have to be too long in the tooth to remember that before 2015, no matter how wealthy an individual was, pensions were used for their original purpose – to provide income in retirement. Then George Osborne introduced ‘pension freedoms’. And, for clients who didn’t need to draw heavily on their pensions during retirement, preserving pension assets, became a tax-efficient way to pass on wealth.

Fast forward to Rachel Reeves’ IHT reforms, due in April 2027, and continuing that strategy will mean clients risk losing more of their pension in tax after death.

It’s a now problem

The implication of the reforms is that pensions will shift from being the most effective IHT tax wrapper, to – in many cases – the least. If residual funds are subject to IHT, between 40%-67% of their value may be paid in tax before beneficiaries can access them, once both IHT and income tax are applied. For those nearing or in retirement with meaningful pension assets, that’s quite a change. Advisers are telling us that they’re already working through how to structure their clients’ retirement plans going forwards.

Integrating pension assets into a broader, holistic retirement plan

In practice, ‘pension last’ strategies are likely to be replaced by a broader holistic approach, where pension assets are integrated into the overall retirement plan and income strategy. The goal being to move more non-pension assets into IHT-efficient vehicles where suitable, and, in some cases, draw on pensions earlier to help reduce unnecessary tax.

Whilst solutions will be individually tailored, some themes are likely to emerge:

1. Clients previously leaving pensions as untouched legacy vehicles may begin withdrawing and spending their wealth;

2. Clients already using pensions for income may increase withdrawals to protect residual values in non-pension assets;

3. Additional pension withdrawals may be used for gifting allowances or regular gifts from surplus income, which could fall outside the estate if planned carefully;

4. Increased reallocation of non-pension assets towards IHT-efficient wrappers, including onshore bonds, trusts, business relief vehicles, whole-of-life-insurance held in trust or structured gifting strategies.

Common among these themes is the idea that some clients will now require access to their pension funds earlier, and in a way which reduces the inheritance tax burden, resulting in a shift of focus away from preservation, towards sustainably decumulating it.

However, accelerating pension withdrawals to strip out capital presents real challenges; how to raise withdrawal rates while still managing sequencing risk, limiting tax drag and avoiding the danger of exhausting the pension too quickly – especially if it’s also being relied on for income.

A solution for maximising income

Just’s Secure Lifetime Income offers a strategic solution for maximising income. Held in an on-platform trust-based personal pension, Secure Lifetime Income is a guaranteed income producing asset, which pays a regular fixed, gross amount into the cash account. Including Secure Lifetime Income can help build resilience in the drawdown plan by reducing the income producing strain on the investment portfolio and exposure to sequencing risk, creating potential headroom in the portfolio to increase the overall withdrawal rate.

Secure Lifetime Income is available:

1. With death benefit — preserving value which falls within the taxable estate;

2. Without death benefit — providing a higher income, with capital removed from the estate on day one. Though this carries the risk of losing the purchase price should the client die early on in the plan.

Critically, as Secure Lifetime Income is held within the personal pension portfolio, if the tax rules change again, the withdrawal plan can be adjusted easily and income can be directed back into the portfolio.

Secure Lifetime Income in action

Here’s an illustration of how Secure Lifetime Income can be included in the retirement plan which can be gifted out of the estate.

It’s based on an individual aged 65, in good health, with £1.5 million held in a drawdown personal pension portfolio, withdrawing £60,000 per year. To help explain the principles, we’ll ignore inflation for the time being.

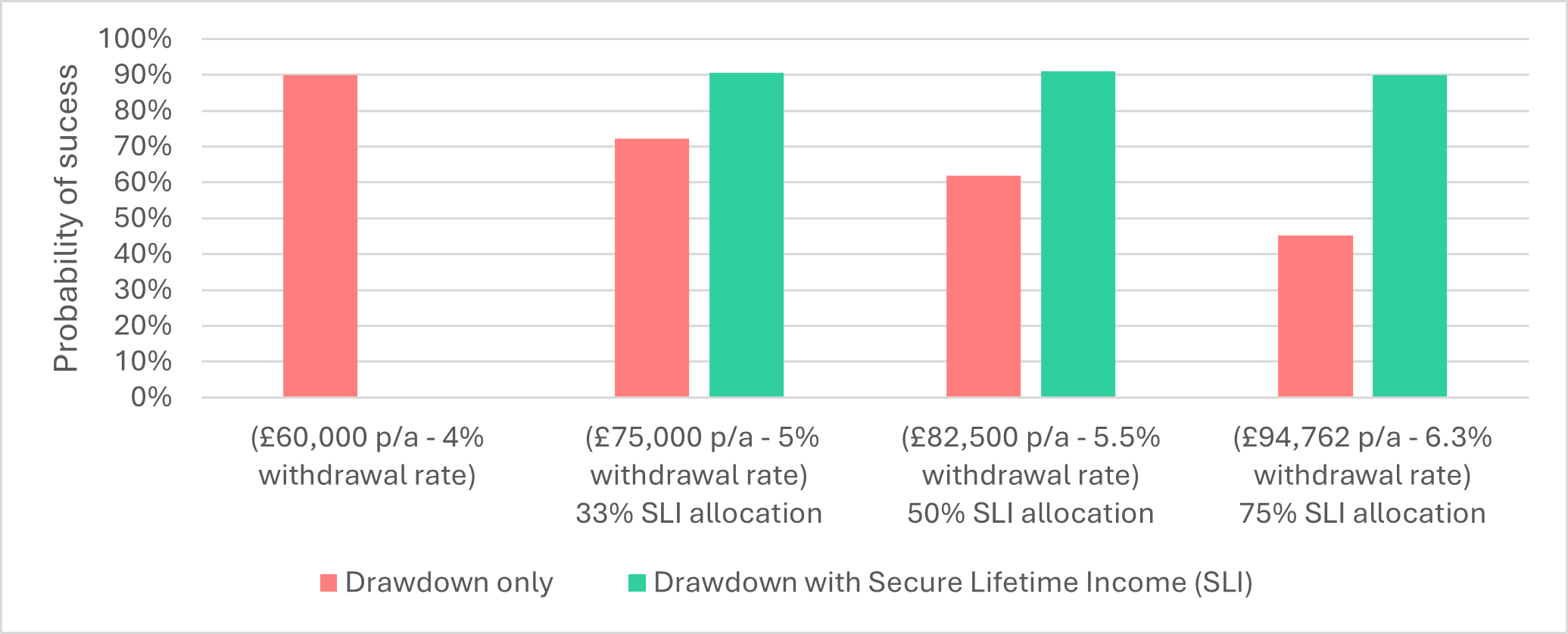

The chart below illustrates blending various allocations of Secure Lifetime Income (without death benefit) into the overall drawdown. In this illustration, a 75% allocation of the portfolio value to Secure Lifetime Income means withdrawals can rise safely from 4% to 6.3%. That’s an extra £34,762 a year, which over a 25-year retirement adds up to £869,050 extracted from the pension, with no loss of sustainability.

Illustration calculated in September 2025 and is based on 65 year old, male, in good health, non-smoker, with a £1,500,000 total portfolio value. Drawdown portfolio scenario is based on 30% UK equities / 30% overseas equities / 30% UK corporate bonds / 10% Gilts. Portfolio asset allocation remains consistent.

What’s more, in this example, the total income generated from Secure Lifetime Income is equivalent to the purchase price within 14 years, when the individual still has a 90% chance of being alive. If tax rules or the client’s circumstances change in the future, income can be re-invested in the portfolio and withdrawals stopped without creating a tax charge.

When the goal is to maximise income without taking extra risk, blending Secure Lifetime Income with drawdown can be a powerful choice over the traditional drawdown approach. This is because probability of success rates for the blended approach will generally be higher and the traditional approach needs strong investment outcomes to deliver the same income. It’s likely, therefore, that pursuing the traditional approach relies on accepting an increased risk of the portfolio being exhausted. Otherwise, withdrawal rates would need to be restricted – limiting the amount of income that can be extracted.

Delivering more income within existing advice models

Including Secure Lifetime Income within existing advice propositions can:

1. Help boost withdrawals from the pension safely, enabling plans to be restructured;

2. Produce potentially higher income with assets remaining on platform and under advice;

3. Ensure the withdrawal strategy can be adjusted if tax rules or personal circumstances change in future;

4. Sit alongside current investment propositions without the need to unpick previous advice;

5. Support transparent client reviews and chosen renumeration models, as it displays a value on platform.

If maximising income is the priority, full annuitisation may be right. However, keeping assets under advice by blending Secure Lifetime Income with drawdown to help achieve a potentially higher income with greater certainty and flexibility, whilst keeping liquidity intact, might well be the answer to soothing the nerves of clients anxious about the IHT reforms.

We’d love to talk

If you’d like to find out more about how including Secure Lifetime Income in your clients’ retirement plans could help you achieve their objectives and better outcomes, we’d love to talk. Please get in touch with your usual Just contact, call 0345 302 2287 or email support@wearejust.co.uk.